Why Do Credit Scores Matter, and How to Know Yours?

Why do credit scores matter? Why does your lender ask for your credit score before giving you a loan?

A credit score is key to obtaining your desired loan amount and excellent loan terms. It is the main factor that decides whether you will get a loan or not. Confused? In this article, you can find insightful knowledge about what the credit score is and its importance, as well as how you can check yours. Read on to learn more.

What Is a Credit Score?

Lenders check your credit score to understand your creditworthiness. A credit score decides whether the borrower will get loans, mortgages, credit cards, and auto loans. Not only this, but it also influences your interest rates and terms of your loan or credit. The higher your score, the more chances you have to borrow credit or a loan.

A credit score is calculated through your credit history that depends on the total amount of debts, repayment history, number of open accounts, etc. But why do credit scores matter for your lender? Your lender uses it to determine your ability to repay the loans on time. Excellent credit scores assure them that they won’t go bankrupt or avoid paying monthly payments and will act as a responsible borrower.

Besides lenders, some employers also review credit scores when you apply for a job. This helps them determine your attitude towards your responsibilities. Many landlords also check potential tenants’ credit scores to ensure whether they’re trustworthy and can make timely rent payments.

How do Credit Scores work?

Your credit score can greatly impact your financial condition, as it’s the main factor that decides whether your lender will give you a loan or not. For instance, borrowers who have a credit score lower than 640 are considered subprime borrowers. The lending organizations charge a higher interest rate to subprime borrowers on conventional mortgages compared to other buyers. This approach helps them secure themselves even when there is a higher risk in offering a loan to the buyer. In most cases, your lender may also require a co-signer or shorter repayment term if you have a lower credit score.

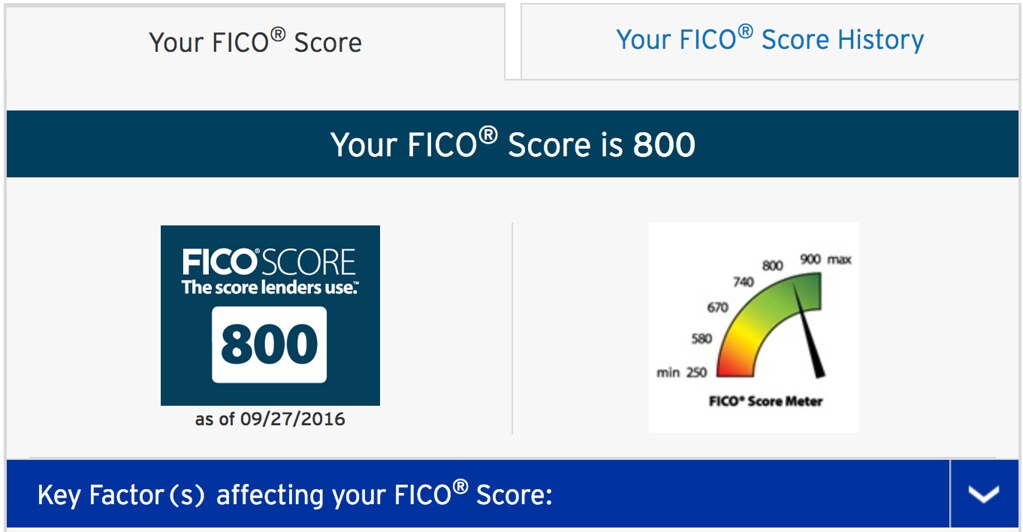

On the other hand, a credit score of 700 or above is considered better. You will be able to get a lower interest rate throughout the loan term- whether it is 10 or 30 years. Credit scores above 800 are considered excellent credit scores. A person with this type of score will receive excellent and favorable terms throughout the life of their loan. Although every creditor has different ranges for credit scores, a lender usually uses FICO score ranges that are:

- Poor: 300 to 579

- Fair: 580 to 669

- Good: 670 to 739

- Very Good: 740 to 799

- Excellent: 800 to 850

Note that your credit score can also impact the amount of an initial deposit you need to pay for the utilities, cable services, smartphones, or rent of an apartment. In fact, lenders often review your credit score even after giving you loans or credits to decide whether they need to change your credit limit or interest rate.

Why Do Credit Scores Matter for You?

Wondering why credit scores matter to you? As we have discussed, a credit score can influence many aspects of your financial life. Having a good or excellent credit score can help you save thousands of dollars throughout your life.

Here are some aspects that will help you understand why credit scores matter to you.

Loan Facility

Do you want a mortgage for your new house? Looking for a car loan to enjoy the benefits of having your own transport? Or do you simply need a credit card to pay for day-to-day expenses? If so, you need to apply for a loan or credit from a lender. Your chosen lender will check your documents and financial health, but most importantly, your credit score, to determine whether you are eligible for a loan.

They will offer you a loan based on their policies. For instance, many lenders only offer loans to individuals with good credit scores, while some provide loans to bad credit score borrowers. After checking your eligibility, a lender will design a loan for you based on your score. In most cases, terms for poor or bad credit score holders are impossible, or at least challenging, to meet.

Striker Requirements of Larger Loans

Applying for small loans is less challenging. Also, you are more likely to get one easily. However, if you want larger loans, you need to go through striker requirements. You might have to make a down payment, get a lower loan term, or higher interest rate.

For instance, if you have a poor credit score, it might hold you back from purchasing a car or house or applying for a personal loan, or simply having to pay more. So, if there is a $30,000 auto loan, you might have to pay $5,100 more compared to other borrowers. For people who want larger loans, it’s best to build a good score before applying for a loan. Additionally, you need to pay $22,500 more than people with higher scores on a 15 year home equity loan worth $50,000.

Interest Rate

Interest rate is the major problem for most borrowers. A higher interest rate means that you are paying for a product than its actual worth. For instance, borrowers with FICO scores around 620 purchasing a $200,000 mortgage have to pay $65,000 more than individuals with a 760 credit score.

Maintaining a higher score can help you save thousands of dollars. You will get the lowest interest rate possible. The worst part is that getting a loan or credit while having a bad credit score throws many people into debt and financial problems, as many people find it challenging to pay higher monthly payments.

Employment

Have you found an incredible job opportunity? But what’s your credit score? Wondering why do credit scores matter?

You might not know, but having a lower credit score may cause hurdles for you to secure an excellent job in a reputable company. A survey of the Society for Human Resources Management indicates that 47% of companies check candidates’ credit scores before hiring them- they do this as a part of their hiring process.

Of course, the job designation also decides whether it will be reasonable to check the score. For instance, higher salary designations like managers and department heads may require a credit check. Once your employer checks your scores, they will decide to hire you based on their policies.

Renting

Your credit score can even impact your search for a perfect house. Many landlords opt for credit checks before signing a lease agreement with new tenants. A bad credit score can prevent you from achieving your dreams.

There are some lenders that will rent you a property only if you agree to pay a higher deposit and fulfill all their requirements before moving in. In most cases, these deposits are hard to pay.

Insurance Coverage

Whether you need insurance for your house, appliances, car, or other things, you need to meet the insurer’s credit score requirement. Generally, life insurance providers also check your credit score to ensure your eligibility for coverage.

Also, many insurance providers only offer insurance to specific credit score holders, while some are ready to provide coverage to borrowers with a lower credit score. However, lower score holders have to pay higher monthly premiums to enjoy the benefit of insurance.

How to Know Your Credit Score?

Since now you know why credit scores matter, it’s the right time to know your credit score. Knowing your credit score will help you improve your score so that you can work on your financial condition. Not to mention, understanding your credit score will also help you determine whether you can apply for certain loans, car loans, mortgages, credit cards, etc.

But how can you determine your credit score? Do you have to calculate it?

You are allowed to get a free copy of your credit score one time every year from the three main credit bureaus: Experian, TransUnion, and Equifax. All you need to do is to visit the site ” WWW.annualcreditreport.com” and fill in the required details to get the score. Besides that, your credit card issuer also gives you free access to your credit score. This way, you can check your score at any time, helping you to notice improvements in your score.

Some credit card issuers like Discover and Citi offer free FICO scores, while credit issuers such as Capital One and Chase provide access to free VantageScores. The best part is that you can easily check your credit score in less than five minutes. You need to log in to your credit card provider’s website or credit score service look for the credit check section. You will notice your score in it and several factors that are impacting your credit score. Moreover, you can use these factors as guidance to improve your score and check your score again after a few months to know whether the tricks helped you. VantageScore and FICO will pull your score from one of the popular and reliable credit bureaus like Equifax, TransUnion, and Experian.

How to Build Credit Score?

Building a good credit score is pivotal to enjoying lots of loans and credit facilities. Improving or building a credit score is not impossible. It might take some time, but it’s worth trying for. Having an excellent credit score can greatly improve your life and promote excellent financial health.

People Who Don’t Have any Debt

Millions of people don’t have a credit score at all because they never applied for a credit or haven’t used them to generate a score. In this case, there are two ways to build your credit score:

- Opt for a credit builder loan that keeps your borrowed money in the savings account or into a certificate of deposit. You can claim this money after you pay monthly payments for a year. Community development financial organizations and credit unions offer credit-builder loans to borrowers. Applying for this option is the best way to save yourself from debts.

- A secured credit card is another option. It offers you a line of credit equal to the cash amount you deposit in your chosen bank. This helps build a credit history that leads to a credit score.

Once you develop a score, you can opt for a credit score simulator to work on the factors that can help improve your score. This approach can also help you determine how these factors damage your score, helping you avoid such problems.

People Who have debt

If you have debt and a bad score, you can build a good credit score to become eligible for loans or credit cards in the future. Since credit scores matter significantly, you need to start working for it. There are several ways to build your score. First, start paying your monthly bills on time. If you have enough income to pay your bills but often forget to pay your bills on time, consider opting for automatic payments.

Another thing you can do is to pay more than the minimum on your credit card. The debt on an account can greatly impact your credit score. By paying more than the minimal amount, you can show that you are working hard to pay your debts. Thus, it will help your credit score. You also need to check whether you have any outstanding medical bills. If you have any unpaid medical bills that you forgot to pay, it will drop your credit score. So, settle your score as quickly as possible.

If you have many debts, you will be paying an interest rate on different outstanding debts every month. You can consider debt consolidation that helps you pay off debt with a relatively lower interest rate on a new credit card. This way, you have to pay one single monthly payment every month, reducing the risk of forgetting to make multiple payments.

Why do Credit Scores Matters: Bottom Line

Now that you know why credit scores matter, it’s time to start building your score. If you have a good score, it’s vital to maintain it by making monthly payments on time and reducing your debts. If you are struggling to build an excellent credit score, you can take the help of financial experts like Credit Follows. With their guidance, you can figure out the best methods based on your financial health and score.