Is Your Credit Score Impacting Business Loans?

Business Loan and Credit Score

A business loan is essential for a startup or business owner who wants to expand an their existing setup. One can use the extra finance for equipment purchases, creating a secure inventory, hiring employees, etc. However, getting a business loan can be difficult if you do not understand critical factors, such as your credit score impacting business loans.

The majority of the people have little or no idea of how their credit scores may impact their business loans, but we will discuss it all below. Many lenders consider a person’s credit score while assessing their business loan application, and the personal credit score helps the creditors determine business trustworthiness.

What Companies Should Worry About Credit Scores Impacting Business Loans?

A personal credit score is an essential metric for almost any company, but its need increases for businesses with a few years under their belt.

Newer companies in the industry that want to expand and grow through finance should also consider personal credit scores. It is essential to prevent your credit score from impacting your business loans because your applications will get rejected if you aren’t careful.

Your credit score reflects how you handle finances, and people who do not handle their credit scores will not handle business loans well either. So, it is essential to understand how your credit score works and a few things that can help you prevent your credit scores from impacting business loans.

How is Credit Score Calculated?

The first credit reports included merchants working together to share information about their shared clients. However, the process became more organized with the start of the Fair Credit Reporting Act back in 1970. The federal government improved the credit reporting quality by prescribing a more structured approach.

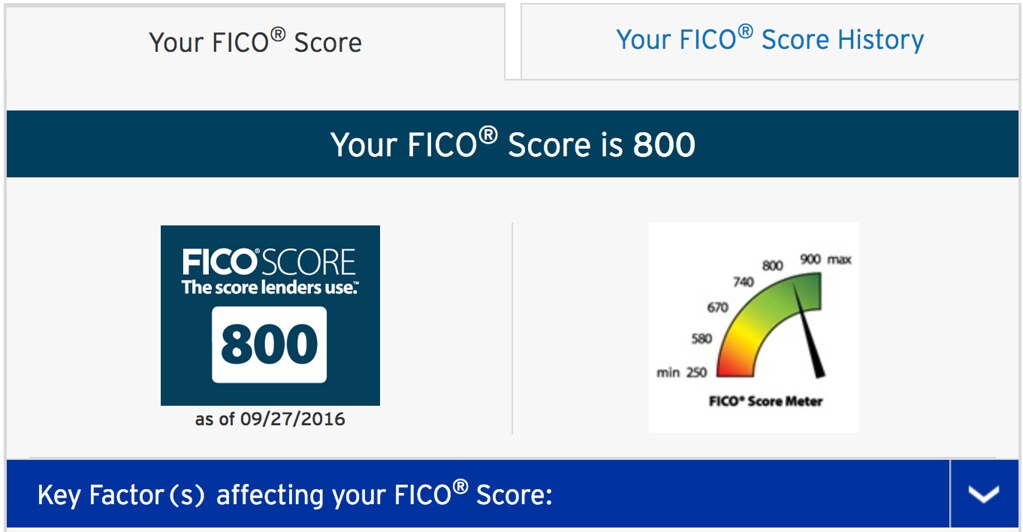

The FICO Score, introduced in 1989, started as a basic formula that helped banks and lenders determine a borrower’s trustworthiness. This score depends on the information collected by credit reporting companies such as Transunion, Experian, and Equifax.

These credit reporting companies have a simple scale ranging between 300 and 850 that titles borrowers according to their financial habits. The primary division of factors and their contribution to the total score is simple, and it is as follows:

35% Payment History

The payment history represents data on a business loan applicant’s payment habits. The following are the most critical factors that make the payment history score.

- Bankruptcy

- Charge offs

- Judgments

- Late payments

- Liens

- Repossessions

- Settlements

All these factors can negatively impact a person’s credit score. So, loan applicants need to avoid these elements for better credit scores.

30% Amount Owed

The amount owed includes everything you owe to creditors, credit card providers, and other lenders. It may also include the amount of down payment you pay on your loans and the remaining loan amount. The lower the owed amount, the higher your credit scores will be. It is one of the simplest ways to prevent your credit scores from impacting business loans.

15% Length of Credit History

The credit history tries to determine your future financial habits so that long-running credit history can benefit you. The length refers to the total time of your accounts running.

10% Type of Credit

There are different credit types that borrowers can choose from, including the revolving, installment, and mortgage. You can prevent your credit score from impacting business loans if you can show the ability to manage different kinds of credit scores.

10% New Credit

The number of hard inquiries your creditors perform on your account will reduce your overall credit score. Different loans like student loans, auto loans, or mortgage approval will not impact your credit score, but issuing a new credit card may negatively impact your account.

Credit Score Information and Business Loans

The credit reporting bureaus have fixed formulas to calculate your credit scores and consider your information.

The information can include your name, age, address, profession, etc. They add all this information to your credit report and provide it to creditors looking for client information.

In addition, the credit reporting companies will add all the information available in the public domain. It can include bankruptcy, legal judgments, lawsuits, etc.

The fewer issues your records have, the easier it is for you to prevent your credit score from impacting business loans.

What can you do In case of Incorrect Credit Report Information?

Poor credit scores are the most significant reasons impacting business loans. Thus, it is essential for credit report bureaus to list everything essential in the report and share it with the creditors.

However, there is a chance that the credit reporting companies may make an error. The reporting bureaus allow the account owners to file a dispute and correct any mistakes within a limited period.

However, error filers need to add context to their applications about something negative in your reports. For example, the Fair Credit Reporting Act 1996 allows filers to add a 100-word statement with their claims. Following are some of the main factors that may be impacting your business loans.

- Divorce

- Job loss

- Prolonged illness

The statement gives the account owners to present their reasons for a bad credit report and get it fixed on time. The credit companies will also list the main reasons for the poor ranking and share the fixed information with your creditors for better financing options.

Do All Credit Reports Impact Business Loans the Same Way?

Three different credit reporting companies create similar reports, but some factors may differ in these reports, depending on the reporting firm.

For example, Experian adds information about rent payments on time, which the other two reporting companies may not.

Similarly, Equifax lists closed and opened accounts separately to help creditors assess your finances better. Transunion does in-depth research and may also add your employment data to the report.

The only difference between these reports is that these firms are competitors, and some creditors may report to a particular reporting company and not the others. Thus, there is a higher chance of a credit score impacting business loans.

Factors that may be Impacting Business Loans

We have already talked about credit scores and the different factors that make these credit scores go up. However, some other elements may impact business loans. Let us discuss them

Poor Credit History

Credit reports are the fastest way to know the factors that can help you prevent your credit scores from impacting your business loans. Depending on an individual’s financial habits, these factors may differ.

However, account holders need to assess each factors separately. Experts claim it is difficult for smaller businesses to get business loans if their credit scores rank less than 700.

Most small businesses have a short credit history that doesn’t give the credit reporting companies sufficient information. It cannot be easy to prevent your credit score from impacting business loans in such scenarios.

Businesses with a credit score of 700 or below should work on improving it if they want to get a reasonable interest rate on it.

Try requesting free credit reporting from any credit reporting companies once a year and locate possible errors. You can fix the errors before filing for the credit report, whereas anyone can check your business credit score.

Limited Cash Flow

The cash flow represents the amount of cash you have and the amount you can repay to the lenders. It is one of the most crucial elements impacting business loans and will determine your success with a business loan.

Lenders avoid dealing with borrowers who cannot return the money, so it is time to improve cash flow if your business loans get rejected.

The best way to have a good business cash flow is to assess each quarter. Business owners can optimize their cash flow on each step instead of fixing it when it gets out of hand. You can calculate your income with your total debt in business to get the ratio of the two metrics.

People with a balanced income and debt ratio will get one as the ratio. Most lenders accept a ratio of 1, but a ratio of 1.35 can increase your odds of impacting business loans positively.

It is understandable if you are unsure of your current finances and can always request a professional to walk you through it. They can also help you prevent your credit score from impacting business loans.

Lack of Solid Business Plan

Creating a proper business plan is a better approach can pitch random ideas to your lenders. It gives you a clear business vision and increases the chances of positively impacting business loans. Creditors are likely to provide loans to startups with a clear idea.

A half-baked plan will not always work in your favor, so it is essential to discuss the business idea in detail and satisfy the loan providers as well as possible. Another effective way to show your seriousness towards the business idea is to create a document and list everything on it. In addition, knowing how to create income projections and explaining the financial prospect of the business plan also helps.

In short, you should know how to explain your business idea and how you will repay the amount you take from the creditors.

Excessive Loan Applications

Some businesses think they can sign up for different loans and then choose one that works best for their needs. However, requesting too many applications is the biggest reason impacting business loans negatively.

You need options, but you can collect the loan information without requesting an actual loan. Professional creditors love meeting potential borrowers and explaining the loan in detail.

Understanding the loans and their terms can help you prevent your credit score from impacting business loans in the long run. Credit bureaus consider extensive loan applications a big red flag, and it will land you severe financial issues if you aren’t careful with it.

Disorganized Approach

Business owners should be mentally prepared to seek a business loan before going to a creditor. It would be best to list everything about your business on paper and fulfill document requirements to increase loan approval chances.

The documentation details can include a detailed section on the following things:

- Balance sheet

- Business licenses registrations.

- Extensive financial records

- Franchise agreements

- Income tax returns

- Loan history

- Personal and business bank statements

- Proof of collateral

You can also use different resources to make your loan applications better. For example, the Small Business Administration (SBA) provides complete guides on how to sign up for a loan. It helps prevent your credit score from impacting business loans and increases the chances of getting pre-approved.

Application errors may make you seem careless and decrease your chances of getting a loan. Inconsistent business practices and bookkeeping will also make you sound unprofessional, impacting business loans.

No Expert Advice

Business owners need to reach out to experts for advice and ensure they know what they do.

Creditors deal with multiple borrowers daily and know the difference between someone new and someone who has prepared.

For example, working with accountants, discussing details, and ironing out application problems is a simple and effective method of increasing loan approval chances.

In addition, you should know about the right kind of capital or business loan according to the industry. The more you know about your requirements, the better you will satisfy the lenders and get a business loan.

Looking for financial help, assistance, counseling, and professional advice can help you get your business loans as soon as possible.

Credit Score Impacting Business Loans: Bottom Line

A business loan is an excellent way to get extra finance on your hands and expand as a business. However, it is essential for business owners to know the best practices to avoid credit score impacting business loans. You should boost your credit score by targeting your personal and business credit scores both.

Borrowers should try to k clear the amounts they owed to get faster approvals. We suggest you reach out to our professionals at Credit Follows for more information, consultation, and advice.