What is FICO Score, and Why is It Important?

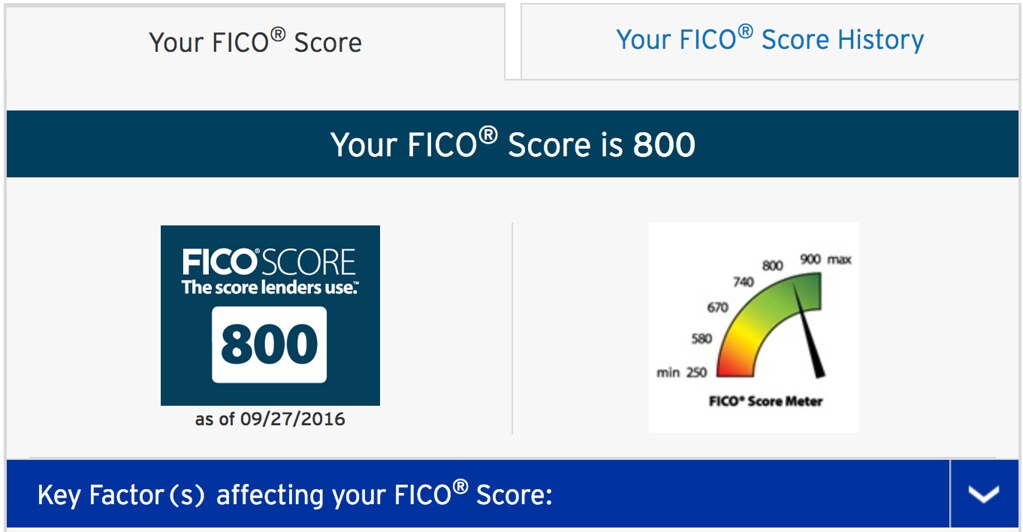

The FICO score is a 3-digit number ranging between 300 to 850 that creditors use to determine how likely you are to make a one-time payment for a debt. It helps the lenders guess the risk involved if they give you a loan.

Similarly, companies like your insurance provider may use the FICO score to determine if you can handle an insurance policy and the best premium amount to set for you.

Even credit card issuers consider the FICO score when determining the interest rate you have to pay. The property managers and mortgage lenders also consider your FICO score while determining your repayment structure and timeline.

What Counts as a Good FICO Score?

The standard of a good FICO score varies for every lender. For example, lenders granting more significant loan amounts will likely require a higher FICO score. As a general rule of thumb, scores above 670 count as a good score.

However, an excellent score ranges from 670 to 740, but it may differ for each lender. So, borrowers should discuss specific details with their lenders or learn about their lending policy before taking the loan.

FICO Score: How Does It Work?

FICO scores include information from three different credit reporting companies. These companies are considered reputable, and their reporting will impact your finances. The credit reporting companies include the following:

- Equifax

- Transunion

- Experian

The responses from these companies help creditors determine a person’s financial habits and credibility. Following are the main factors that may impact your FICO score.

- Payment history

- Amount owed

- Length of credit history

- Credit mix

- New Credit

However, the final criteria for the ranking may vary depending on the kind of FICO score the creditors consider. FICO score eight, and FICO score 9 are the base standards for the credit ranking. However, different kinds of lenders may have different standards.

For instance, a mortgage lender may consider the FICO 9 score, but the FICO 8 ranking is the most widely accepted. Similarly, auto industries may consider the FICO Auto Scores, and the mortgage lending services consider the FICO scores 4 and 2 in most cases.

FICO Score: What Impacts it?

The final FICO score depends on various factors, and understanding them is vital. Let us take a closer look.

Payment History

Payments history is one of the most crucial elements determining a person’s FICO score and makes up 35% of the total FICO scores. It is a major rreason why individuals with a poor payment history are less likely to have a poor FICO score.

However, the payment history criteria are not as simple as you may think. For example, the severity and the frequency of late payments matter the most, which applies to situations like lawsuits and general bankruptcy filing.

The payment history also represents a person’s general financial habits, so fixing the payment history is more challenging. People need to maintain on-time payments, stay consistent, and avoid defaults on future payments.

The payment takes around six months to refresh, so we suggest fixing it right away if you have a poor payment history.

Amount Owed

The amount you owe is the second most crucial factor for a FICO score. It makes around 30% of your FICO score, and maintaining a balanced minimum payment throughout the year can help. You can reduce your debts quickly and avoid any long-term FICO score damages.

Credit History Length

Credit history represents how long a particular account has been under a user’s name. Your FICO score increases if you own the same account for a long time. The credit history length makes up around 15% of your FICO scores and it is one of the most difficult metrics to maintain if you have just started improving your score.

However, following the right approach and maintaining your credit history long enough will help you create a better score. The biggest problem is that account owners cannot go back in time and create their accounts earlier, but you can use this metric by keeping your oldest account open.

Note that people who have started working on their credit scores or have new banks may find it relatively more challenging to maintain this metric. They can still focus on the other factors and boost their FICO score.

Credit Mix

The credit mix involves credit report combination as well as the installment loans. People often face issues with this metric because of credit reporting problems. While many credit reports are accurate, there is a chance that you may encounter an error on the report from time to time.

It is essential to be more consistent on your credit reports to report these errors on time. Consumers can report the errors for a specific period after receiving the reports.

You can identify problems with the report and resolve them to improve the 10% of your FICO score based on the credit mix. Similarly, if you have a credit card, you can improve your scores by applying for a small loan and making on-time payments for a better reputation.

New Credit

Credit reporting companies check your credit history while determining the correct score. So, your FICO score will reduce if you have multiple newly opened bank accounts because the bank accounts may give an impression that you cannot manage your credit line and need to switch accounts repeatedly.

It will make 10% of the total FICO score, and you can manage it by fixing your approach towards it. Nevertheless, fixing the new credit ranking is essential if you plan to apply for a mortgage loan or car insurance soon.

FICO Score Ranges: How do they Work?

The FICO score ranges between 300 and 850, depending on the aforementioned factors. Understanding the FICO score is essential for making informed decisions.

Less than 580

Any FICO scores below 580 count as poor and can be a huge financial problem for consumers. Individuals with 580 FICO scores are often considered as risky borrowers and get no financial relaxation from the creditors.

580 to 670

Individuals with a FICO score between 580 to 670 count as Fair and may get loans from many lenders. However, they may have to compromise on the terms of the loans because the creditors will not consider their negotiations.

670 to 739

Ranges between 670 and 739 qualify as a Good FICO score higher than the national average. These individuals will have fewer problems getting a loan from a lender because of their credit performance. These people can also negotiate some terms of the loan agreement.

740 to 799

The FICO scores ranging from 740 to 799 count as Very Good and are always higher than most Americans have. These borrowers have a higher chance of getting a more considerable loan amount approved, and the lenders are more willing to provide the amount and negotiate the repayment terms.

800 to 850

People with FICO scores between 800 to 850 have an Exceptional ranking and are the highest-rated group. These borrowers get their loans approved almost every time and can convince the lenders to make amendments to the loan agreement. However, the exact loan rules may differ for each lender and the borrower’s situation.

How Can You Check Your FICO Scores?

Those curious about their current FICO scores should know they can check their FICO scores through different sources. Consumers can start by assessing their credit card reports on the credit card provider’s website.

The websites have all the FICO score information listed that you can check to know your current status. In addition, consumers can also visit the FICO Website and find relevant information directly from them.

Monitoring your current FICO score can help you choose the best solution, change the course of your plan and make other adjustments to your financial strategy for an improved score.

How Can You Fix Your FICO Scores

FICO scores are crucial as they impact your mortgage, insurance, loan amounts, premium payments, and other areas. Understandably, some consumers may have undesirable FICO scores.

However, it does not mean the score should stay low. Here is a list of standard methods to help you fix your FICO score. However, you need to practice these tips for more extended periods if your score is poor.

Check Your Accounts Regularly

The majority of the people with a poor FICO score have no idea about their poor ranking, and they only get to know about the problem when they need a loan approval or an insurance policy. So, improving your FICO score begins with staying vigilant with your account progress and scores.

You should regularly check your scores by requesting a free report from any credit reporting company. A decent breakdown is to request a report from each company every three months. This way, you will monitor your scores for nine months straight without paying a penny.

Pay Your Bill On Time

You cannot expect long-term changes in your FICO scores if you are not ready to make some financial decisions. The score will not stay up if you keep missing out on your payments or keep defaulting on them repeatedly.

Consumers must take responsibility for their actions and start paying their bills on time. Increased on-time payments will improve your scores and keep them up before you know it. You can also ask your creditors for a payment extension by explaining your case to them until you can get back up on your feet.

Avoid Getting New Credit Cards

As we have already mentioned above, your credit history is a vital element of your FICO score. A new card increases the credit utilization rate and negatively impacts your credit score. It is best to manage your expenses on your existing card limits and pay for the expenses via cash.

Lesser credit card use will decrease your credit utilization rate boosting your FICO scores significantly. You can calculate your current utilization by determining your existing credit card limit and the amount you owe right now. Keeping the ratio under 30% is best to avoid risking your FICO scores.

So, if your card limit is $10,000, avoid having loans for more than $3,000. This simple trick will increase your scores and help you enjoy better scoring status.

Do not Close your Existing Accounts

A long-running bank account is one of the most powerful ways to maintain and increase your credit scores. Creditors take past accounts and their histories into consideration while formulating your scores. Therefore, having a long credit line with the same account will give the impression that you know how to manage your finances.

Consumers who open and close accounts frequently can seem suspicious as it is a huge red flag for the professionals determining the credit scores.

You can also consult with the bank if you worry about the annual charges or similar expenses. Maintaining a bank account will ensure that at least 15% of your FICO score is in your favor.

The professionals will calculate the average age of your bank accounts for the final score, so the longer the bank account runs, the better.

Consult with the Creditors

Discussing your current scores with the creditors can help you get the assistance you need to boost your status. You can mention having issues with the repayment and request an extension or discount on the loan.

It is best to be upfront with them because avoiding the topic will only make the conditions unfavorable for you. Try to alert them as soon as you know you have issues with the repayment.

Wrapping It Up

A person’s FICO score is a crucial metric for their financial reliability. People need to work on improving their scores for better financing options. If you still have trouble with boosting your FICO score. Our professionals at Credit Follows are here to help you out. We will ensure that your credit reports show improved scores as soon as possible.